How custom software ages | Application Development Video Series, Episode 1

We don’t typically think of software as something that can age. The code is written and run on a computer, so it doesn’t age like hardware does or like people do. It becomes obsolete or becomes less functional, unable to keep up with the demands of the business and the business users. Software is usually written based on a snapshot of a business need for a certain period or range of time. Unfortunately, software doesn’t change dynamically the way the business does. Businesses can change, market demands can change, the number of users can change, and the software can have trouble keeping up with that.Read More

Software Selection: the Buy versus Build Spectrum

Software Selection Matters for Your Business

In our evolving world, good software can be one of the most effective differentiators that a company can leverage for growth. Implemented thoughtfully, software can be a multiplier for your existing staff, or it can surface information for better decision making that was previously locked away in spreadsheets.

Custom Software Application Provides South American Producer with Improved Inventory Tracking

Preventing Inventory Loss with Custom Software

Entrance has long partnered with Midstream service company TG Mercer to develop a custom software application, called SpreadBoss, that provides cradle to grave pipeline tracking. This past year, TG Mercer started working with one client in South America to provide better tracking of their inventory.

As they looked further into the project, TG Mercer realized that adding modules on to SpreadBoss would be the best way to provide the visibility this producer needed.

The first of these additions is the ability to divide large yards into zones, with a catalog of corresponding inventory in each zone. In addition, as employees check inventory into a given zone, they have the option to define a new item in the database, which was previously not possible.

See the picture to the right for an example of zoning in the application.

Quality Control Capabilities

An inventory reconciliation module takes this process a step further. On a quarterly basis, the customer can validate the complete inventory in a given zone. Employees scan every item, and when this is complete, SpreadBoss compares the expected inventory with actual inventory. Items that are lost or in the wrong zone can then be logged for action.

This quality control process will help TG Mercer’s clients to achieve better control of high value inventory. Particularly as the size of oil and gas facilities increase, this level of visibility will help prevent assets from hiding in plain sight.

For more on the benefits of custom web applications, check out this page. Read more about our partnership with TG Mercer here!

Custom Software: Tracking Pipeline Damage for Oil and Gas

Releases (or leaks) are very important to pipeline companies. Common causes for these leaks are equipment damage, both internal and external corrosion, manufacturing failures, and natural hazards like shifting land. The U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) is responsible for releasing reports regarding pipeline releases or leaks. As a result, the ability to track damage that could cause pipe failure and report on it is important.

Custom Energy Software: Following Pipelines from Cradle to Grave

We recently posted a news item about improvements to a custom software application that we developed for a client involved in the midstream service industry. They manage joints of pipe from cradle to the grave, and we recently released two new modules that has extended their tracking ability even further.

Milling: Getting in from the beginning

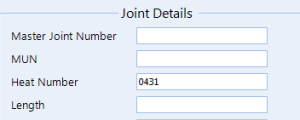

The first module allows the client to barcode joints of pipe as they are being milled. In addition, they capture the run number, coil number, and other data that helps identify that specific piece of pipe. After all of this has been completed, they commit the joint to the system.

The first module allows the client to barcode joints of pipe as they are being milled. In addition, they capture the run number, coil number, and other data that helps identify that specific piece of pipe. After all of this has been completed, they commit the joint to the system.

Welding: the second step in the process

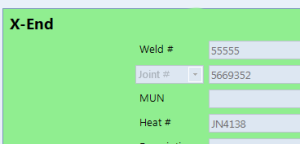

The second module follows the joint of pipe to welding. This part of the process is very important for quality control, as welds are a common point of failure in a pipeline. One employee stands on the X-End of the pipes to be welded, while another stands on the O-End. Both of their computers are connected to the same session in the system, and updates made on one end are reflected on the other.

Each worker scans the pipe to verify that the joint number is correct, and then the double jointed (DJ) weld is completed.

Afterwards, the pipe is x-ray tested from the X-End to ensure that the weld is sound. Coming additions to the module will allow the client to track this test and then follow the pipe on to coating.

Afterwards, the pipe is x-ray tested from the X-End to ensure that the weld is sound. Coming additions to the module will allow the client to track this test and then follow the pipe on to coating.

Each incremental step in the process of adding to the application allows our client to provide customers with a more and more complete view of what is happening to their property.

For more on solving business problems with custom software, check out this post. Or read about how codifying your business logic in custom software can help set your company apart…

Entrance Enhances SpreadBoss Towards Cradle-to-Grave Pipe Tracking

Last year, we announced the completion of SpreadBoss, a custom software logistics support tool that allows thousands of joints of pipe to be tracked, providing customized inventory reports and creating a pipeline status history database. Entrance and TG Mercer have pushed the ability to track joints of pipe from cradle to grave that much further with the recent release of new modules for milling and welding.

Previously, TG Mercer would take custody of joints of pipe, assuming that they had been correctly milled and coated. They can now can insert their own employees at the very beginning of the process, allowing joints of pipe and their whereabouts to be entered into the system that much earlier. After this point, TG Mercer employees follow the pipe to the welder, where further quality control can be performed on-site.

This improved tracking ability has helped TG Mercer make more strides towards preventing inventory loss, in addition to giving customers better visibility into where project hold-ups are coming from at the very beginning.

For more on how this custom software solution works, check out our blog post, with screenshots.

To find out about the engineering intelligence behind the partnership with TG Mercer, read this article…

Oil and Gas Software the Key to Optimizing Industry Growth

I’ve discussed in a previous post the impact that the oil and gas industry has on jobs in the United States. I took note this past week of an article in the Oil and Gas Financial Journal regarding the testimony of Daniel Yergin (author of The Quest: Energy, Security and the Remaking of the Modern World) to the US House Energy and Commerce Subcommittee on Energy and Power. His statements regarding the oil and gas industry’s contributions to the economy are worth highlighting:

- Oil and gas production currently supports 1.7 million jobs, with growth to 3 million by 2020.

- Even in areas where there is no activity, long supply chains mean jobs are created everywhere. For example, in New York, where shale gas development is banned, at least 44,000 jobs have been created by the industry.

Improved Timesheet Reporting with One Simple Fix

One of our most successful projects is for a client called TG Mercer. We created a pipeline logistics system for them that automates the tracking and management of their inventory for its entire lifecycle. Entrance recently released an update to TG Mercer to improve their reporting capabilities through improvements to their timesheet process.

TG Mercer has employees working across the globe, in a number of different time zones. As managers reviewed reports, employees clock-in and clock-out times were logged either as Central Standard Time, or the timezone the managers themselves were working in. Depending on the time zone, employees could look like they were clocking in a whole day later or earlier. In addition, it resulted in some rather bizarre clock-in times, for example 1:00 am instead of 8:00 am.

Business Collaboration for Tax Compliance After Royalty Unbundling

Here at PDI, we just heard from Dennis Cameron of WPX Energy and Pam Williams of Shell, who spoke on the impact of federal unbundling on royalty compliance. As of April of 2012, unbundling audits have increased exponentially and remaining compliant with the changing set of rules has become time-consuming and nye impossible, because many of the pieces of documentation are not kept in locations available to those creating compliance reports. This leaves compliance experts “gathering data from documents, contracts, and even email” according to Williams. She has even personally “called down people in the field to ask for information about equipment costs, compressor discharge pressures, etc” in order to gather the information she needed to even begin tracking unbundled tax compliance. We’ve talked a lot about chasing down information from various parts of the company, the gap between field and office, and even briding the emerging generation gap as experts retire, and unbundling has all of the common characteristics of a scenario where business collaboration can make all the difference.

TG Mercer and Entrance – Engineering Intelligence for Midstream Energy

Our partnership will push the entire midstream forward in efficiency and safety compliance with strategic software.

TG Mercer and Entrance have partnered to create SpreadBoss, a logistics support tool that allows thousands of joints of pipe to be tracked, providing customized inventory reports and creating a pipeline status history database. Not only does the software reduce time and effort spent on tracking pipe, it also provides accurate and timely data capture, as well as consistent documentation. The software solution has become a differentiator for TG Mercer, because it makes them the best in the industry for providing fast and accurate field data for corner office decisions, while reducing the labor cost of that information and making it easily available for regulatory and safety purposes. The project was recently covered in Pipeline and Gas Journal!

Engineering Intelligence for Pipeline Safety

At a recent industry breakfast, a panel of speakers from Embridge, TerraFina, Plains All American, and the Bauer College of Business discussed their perspectives on both the boom and the coming challenges for the midstream sector. With the introduction of fracking and horizontal drilling, production has increased beyond the transportation infrastructure’s ability to move those hydrocarbons to factories and the market. And with the market flooded with natural gas, both Plains All American and Terrafina are pushing to export. All of this remains good news for the Midstream, because even the best condensates aren’t worth anything if you can’t get them to market.

Entrance Software Launches Field Testing for SpreadBoss

Entrance has just launched an exciting field testing phase of a custom software product for TG Mercer that will revolutionize pipeline inventory tracking, saving the company hassle and money, and passing huge savings on to their customers.Read More